Tuition & Cost

Affordable, High-Quality Education

At Susquehanna University, we’re committed to helping make your education attainable. Nearly all students receive financial assistance and most graduate in just four years, saving valuable time and money.

As part of our commitment to your education, Susquehanna offers a flat tuition rate for undergraduate students enrolled in 12 or more credits per semester. Part-time students, taking fewer than 12 credits, are billed per credit hour.

For Future Students

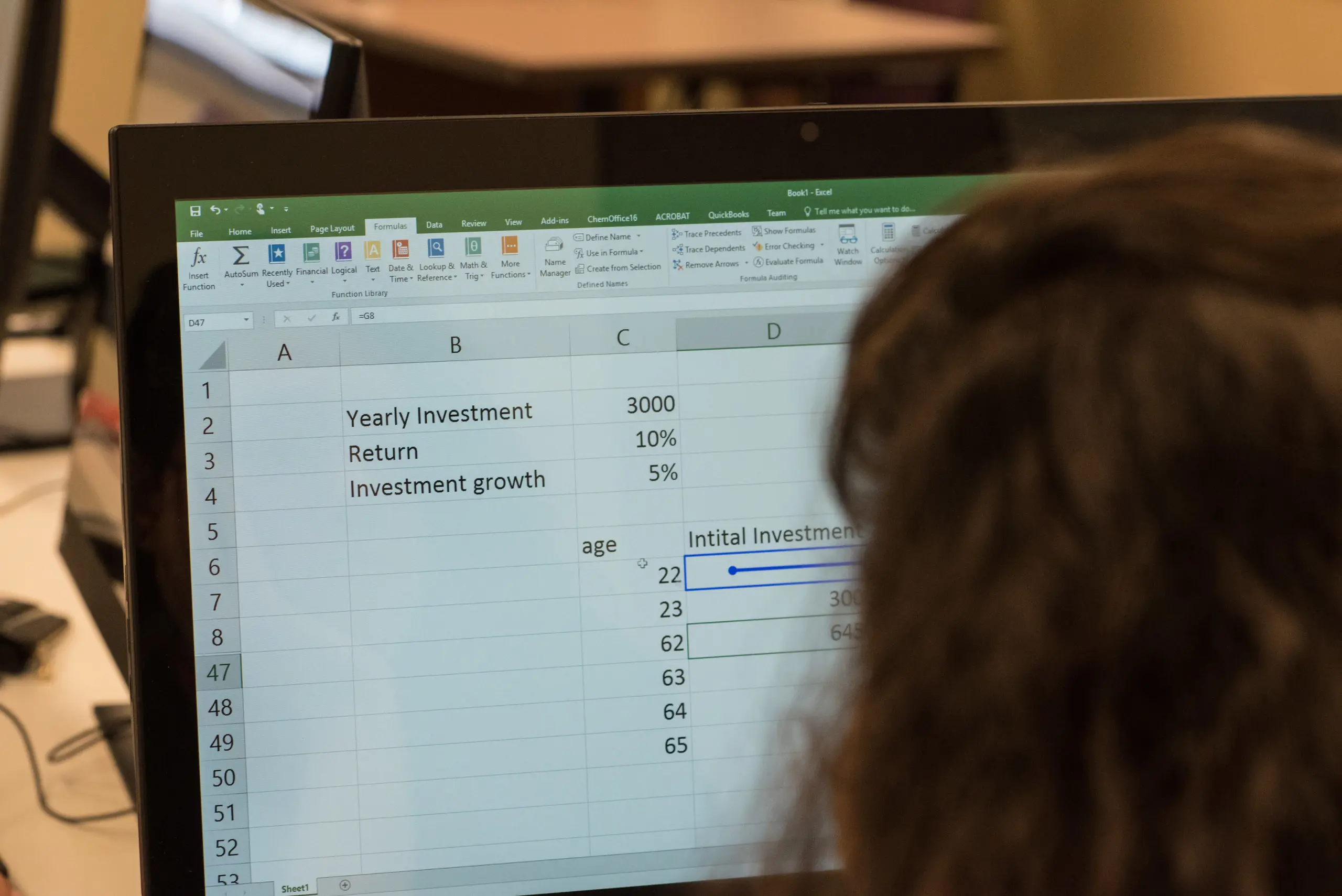

Calculate Your Cost

Our net price calculator provides an approximation of what a first-year, undergraduate student can expect to pay to attend Susquehanna University.

Tuition & Cost

2025–26 Cost of Attendance

Living on Campus

Susquehanna University is a residential campus that guarantees undergraduate housing for all four years.

Tuition and cost listed below reflect Susquehanna’s published cost before applying any merit- or need-based aid.

| Students On Campus | Per Semester | Per Year |

| Tuition | $30,550 | $61,100 |

| Comprehensive Student Fee | $550 | $1,100 |

| Housing (Double Room) | $4,600 | $9,200 |

| Food (Orange Dining Plan) | $3,800 | $7,600 |

| Total Direct Charges | $39,500 | $79,000 |

Commuting from Home

To be approved, commuting students must live within 45 minutes of campus. For eligibility questions, email Residence Life.

Tuition and cost listed below reflect Susquehanna’s published cost before applying any merit- or need-based aid.

| Commuter Students | Per Semester | Per Year |

| Tuition | $30,550 | $61,100 |

| Comprehensive Student Fee | $550 | $1,100 |

| Housing | $0 | $0 |

| Food | $0 | $0 |

| Total Direct Charges | $31,100 | $62,200 |

Indirect Costs

Indirect costs are additional expenses that vary by student and are dependent on individual circumstances.

Tuition and cost listed below reflect Susquehanna’s published cost before applying any merit- or need-based aid.

- Transportation (dependent on your residential status) — $700 to $1,800 per year

- Books, course materials, supplies and equipment — $1,200 per year

- Commuter budget allowance (if approved to commute from home) — $3,700 per year

- Federal student loan fees (for direct loans) — $70 per year

- Miscellaneous education-related expenses (e.g., a reasonably priced computer) — $1,130 per year

2025–26 Special Fees

Tuition and cost listed below reflect Susquehanna’s published cost before applying merit- or need-based aid.

New Student

- Enrollment deposit, applied to direct cost balance — $500

Academic

- Audit fee — $835 per credit hour

- Music lessons for students not seeking a music degree (30 minutes per week) — $425 per semester

- Part-time student tuition — $1,945 per credit hour

- Teacher intern or master’s degree (Summer 2025) — $635 per credit hour

- Teacher intern or master’s degree (Fall 2025/Spring 2026) — $660 per credit hour

Housing

- Single room, if approved — $5,525 per fall/spring semester

- Summer 2025 housing (double room), if approved — $245 per week

Parking

- All students may park on campus with a permit in designated areas. A parking permit fee is charged upon processing by Campus Safety.

Summer and Winter Online Sessions

- Summer 2025 courses (per credit hour) — $625

- Winter 2025–26 courses (per credit hour) — $650

Cost of Attendance

The cost of attendance includes both direct costs — charges billed by the university — and indirect costs, which are estimated out-of-pocket expenses not included on your bill. Combined, these costs help create a budget used in determining your financial aid eligibility.

Comprehensive Student Fee

The Comprehensive Student Fee is mandatory for all full-time undergraduate students (enrolled in 12 or more credits per fall and spring semesters) — applicable to residential, commuter and study-abroad students. The fee supports nonacademic student services like student activities, student well-being and care services, community transportation programs, environmental services, the fitness center, career counseling, technology services and infrastructure, as well as a variety of other services and amenities offered to students by the university.

Housing

Undergraduate students, unless approved to commute from home, must live on campus. On-campus housing is guaranteed all four years. By default, students are assigned a double room. Housing includes the use of laundry machines at no additional cost.

Food — Dining Plans

Students living in university-owned housing, except for those in Liberty Alley Apartments and 18th Street Commons, are required to purchase a dining plan. If a student does not select a dining plan, they will be enrolled in the default Orange Dining Plan. Students have the option to modify their dining plan until the end of the first week of classes each semester. Students residing in Liberty Alley Apartments or 18th Street Commons, as well as commuter students, may choose from multiple dining plans or opt out entirely. Explore dining plan options at the O&M Dining website.

Insurance

International students must have health and accident insurance, which is billed directly to your account.

Past-Due Bills — Interest & Fees

A past-due balance is the remaining amount from the previous month after applying any payments received and excluding current month charges. Interest is charged at 1.5% per month on any unpaid past-due balance, including accumulated interest. Students are responsible for all costs associated with balance collection, including accrued interest charges, collection fees and attorney fees incurred by the university.

Other Fees

Certain courses may have special fees.

Students taking non-degree-required individual music lessons (30 minutes per week) must pay a per-semester fee, which is added to their account upon submission by the Department of Music.

Withdrawal Policy

Withdrawing from Susquehanna University can have financial implications. Review our Withdrawal and Tuition Adjustment Policy to understand how tuition, fees and financial aid are affected.

SUSQUEHANNA By the Numbers

More Than Metrics

Where Passion Meets Purpose

Straight from the Nest

“Financially, attending Susquehanna made a lot of sense because the package I was offered was unmatched. That was one of the major reasons I chose this school.”

— Ryan Horst ’26

“Susquehanna offers a number of strong scholarships and grants. Ultimately, I knew it was the best choice for me and my family — and looking back, deciding to come to Susquehanna was one of the best decisions I’ve ever made.”

— Alice Polcrack ’26

“One of the main things Susquehanna University offered me — something I didn’t see as much at other schools — was the wide range of scholarships. I received several music scholarships in addition to a presidential scholarship. So, financially, choosing Susquehanna was an easy decision.”

— Clayton Maxwell ’26

A Smart Investment with Proven Results

Key FInancial Resources

Financial Aid

At Susquehanna University, we understand that your education is one of the largest and most significant investments of your lifetime. That’s why we’re committed to making a world-class education accessible through a wide range of financial aid options.

International Tuition & Fees

Susquehanna University seeks academically qualified international students as part of a long-term commitment to global engagement. We offer merit scholarships to qualified international students who are offered admission. No “full cost” financial aid awards are available.

Scholarships & Grants

Scholarships are awarded to qualified students by Susquehanna and others and do not have to be repaid. Many scholarships are awarded independent of financial need, although those through our gift endowment program are based on financial need.

Loans & Financing

Learn about important dates, terms and loan types in our loans & financing hub.

Payment Plans

Susquehanna offers flexible, interest-free monthly payment plans to help families manage education costs. Spread all or part of your semester’s charges — tuition, fees, housing and dining — over three to six automatic installments, with no credit check or loan application required.

Quick Links

Power Your Readiness

| Tuition and Fees | On Campus | Living at Home |

| Tuition | $58,750 | $58,750 |

| Comprehensive Student Fee | $1,100 | $1,100 |

| Housing (Double room) | $9,000 | $0 |

| Food (Platinum Meal Plan: 21 meals a week/3 a day) | $7,100 | $0 |

| Total Direct Charges | $75,950 | $59,850 |

| Commuter Budget Allowance | $0 | $3,700 |

| Books, Course Materials, Supplies & Equipment (Estimate) | $1,200 | $1,200 |

| Miscellaneous (Estimate) | $1,080 | $1,080 |

| Transportation | $700 | $1,800 |

| Federal Loan Fees (If you take direct loans) | $70 | $70 |

| Total Cost of Attendance Before Aid | $79,000 | $67,700 |

The budgets above are approximate total costs for fall and spring semesters before any financial aid awards.

Students who take fewer than 12 semester hours in a semester are billed per semester hour instead of the full tuition.

Students who choose a single room are charged $10,810 annually ($5,405 per semester).

2024–2025 Special Fees

- Residence Life Convenience Fee; student converts double to single without approval — $150

- Single room (per semester) — $5,405

- Music lessons (per semester; 30 minutes per week) — $425

- Teacher intern or masters (fall/spring) per credit hour — $635

- Tuition per credit hour (part-time student) — $1,870

- Audit fee per credit hour — $805

- Winter ’24–’25 courses (per credit hour) — $625

- Enrollment deposit (for first-year students) — $500

| Tuition and Fees | On Campus | Living at Home |

| Tuition | $56,600 | $56,600 |

| Health Fee | $400 | $400 |

| Activity Fee | $400 | $400 |

| Housing (Double room) | $8,850 | $0 |

| Food (Platinum Meal Plan: 21 meals a week/3 a day) | $6,850 | $0 |

| Total Direct Charges | $73,100 | $57,400 |

| Commuter Budget Allowance | $0 | $3,700 |

| Books, Course Materials, Supplies & Equipment (Estimate) | $1,200 | $1,200 |

| Miscellaneous (Estimate) | $1,000 | $1,000 |

| Transportation | $630 | $1,630 |

| Federal Loan Fees (If you take direct loans) | $70 | $70 |

| Total Cost of Attendance Before Aid | $76,000 | $65,000 |

The budgets above are approximate total costs for fall and spring semesters before any financial aid awards.

Students who take fewer than 12 semester hours in a semester are billed per semester hour instead of the full tuition.

Students who choose a single room are charged $10,630 annually ($5,315 per semester).

Have Questions?

Contact Us

Student Financial Services

514 University Ave.

Selinsgrove, Pa. 17870

Location

Student Financial Services Office

Phone & Email

570-372-4450