Accounting

Analyze data to provide meaningful insights that help clients and businesses prepare for their futures.

Accounting Degree

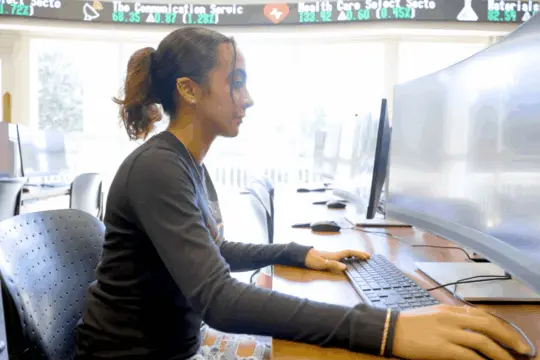

Landing your first job can be easier when you already have experience that employers want. As an accounting student at Susquehanna, you’ll gain the skills, hands-on experience and knowledge to excel in whatever industry you’d like.

Our grads have a high rate of success landing jobs from Big Four accounting firms to boutique firms, financial institutions and other corporate roles.

Understanding rules and regulations is just one factor that determines career success. Today’s accountants analyze data to provide meaningful insights that help clients and businesses prepare for their future. Because our curriculum is rooted in the liberal arts, you’ll develop essential skills that the most sought-after accountants excel at — writing, teamwork, presentations, critical thinking, interpersonal relationships and leadership.

CPA Licensure

Earning a Certified Public Accountant license is the gold standard in accounting, and Susquehanna’s program is designed to help you get your CPA quickly and efficiently. In just four years, nearly all of our majors earn the necessary 150 credit hours to take the CPA exam. This allows you to save a year of college costs and start earning a salary a year sooner. It’s a double net gain for you.

International Internships

Additionally, our business school guarantees, but does not require, international internship placements. This means that you can increase your opportunities to develop cross-cultural competencies and international business skills, enabling you to thrive in an interconnected and dynamic global economy.

Prepare for Your Career in Four Years, Not Five

Save a year of tuition and start your career sooner. Accounting graduates often need to complete 150 semester hours of college credit to become a certified public accountant (CPA).

At most schools, it takes five years and a master’s degree to fulfill the 150-hour requirement. Susquehanna’s program is better! You can complete 150 hours over four years in a curriculum featuring active learning, real-world internships and advising by professors with academic and professional credentials.

Future-Ready Skills

Explore Susquehanna University’s accounting degree to gain the skills employers seek. Intern at top firms, receive mentorship from experienced professors and excel at the Sigmund Weis School of Business. Susquehanna graduates secure positions at leading companies like JPMorgan Chase to Deloitte.

SUsquehanna By the Numbers

More Than Metrics

90%+

of majors earn 150 credit hours to be eligible for the CPA exam in four years

95%

of students study abroad

99%

of students receive financial aid through academic merit scholarships and need-based grants

Academics100%

of students gain professional experience through internships

From Cap & Gown to Career Trajectory

You can earn 150 credit hours, enough to be eligible for your CPA license, in just four years at Susquehanna. With our emphasis on critical thinking skills and international perspectives, you’ll be well-prepared to land a lucrative job upon graduation, or perhaps even before.

Explore Your Studies

Program Resources

A Glance Into Your Degree Pathway

With support from advisors and course planning tools, your time at Susquehanna is carefully designed to help you succeed. This example provides a glimpse into your degree experience, but you’ll have plenty of opportunities to customize your path with electives or study abroad programs that reflect your passions and career goals.

This course offers an overview of business fundamentals, functional areas of business, business careers and opportunities provided by the Sigmund Weis School of Business. The course enables students to assess their interest in business, and it prepares them for their subsequent business courses and careers. A project-based approach enables the integration of critical thinking, strategic analysis, teamwork and communication skills. The course culminates with team presentations of case analyses to invited business executives. Business majors only. Credit may not be received for both MGMT-196 and MGMT-138. 4SH. CC: First-Year Seminar.

Provides an introduction to the basic concepts and standards underlying financial accounting systems. Focuses on recording and communicating financial information for use by investors, creditors, regulators and other external uses. Covers theoretical and practical issues related to the accounting and reporting of assets, liabilities, owners’ equity, revenues, expenses, gains and losses. Basic financial ratios are introduced and interpreted. Prerequisites: School of Business major or sophomore standing. 4 SH.

Introduces aggregate economics. Emphasizes current issues such as unemployment, inflation, stagflation, monetary and fiscal policies and international economics. 4 SH. CC: Social Interactions.

A basic introduction to data analysis, descriptive statistics, probability, Bayes’ Theorem, distributions of random variables and topics in statistical inference. (Students may earn credit for only one of the introductory statistics courses offered by the departments of management, psychology or mathematics.) 4 SH. CC: Analytical Thought.

Provides an introduction to the fundamental concepts and commonly used tools in managerial accounting. Focuses on how to identify, measure, analyze and interpret accounting information from the manager’s perspective. Topics include traditional and emerging costing systems, cost behaviors, cost-volume-profit analysis, variance analysis, performance evaluation and management decision making. Prerequisites: ACCT-200. 4 SH.

Provides an introduction to the conceptual framework of financial accounting and in-depth coverage of reporting issues related to operating activities of business enterprises. Covers the preparation, presentation, and interpretation of the financial statements, with emphasis on revenue recognition, cash, receivables, inventory, and long-term assets. Students also gain an understanding of the standard setting process and the codification system of the Financial Accounting Standard Board (FASB). Prerequisite: ACCT-200. 4SH.

This course focuses on identifying and clarifying individual values, skills, interests and personality type to develop suitable career objectives, placing emphasis on the connections between career preparation, academic choices and co-curricular activities. Students learn how to construct a resume and cover letter and how to conduct an employment search. Primary theories used to teach career planning and development include trait and factor, developmental, learning and socioeconomic theories. Prerequisite: sophomore standing. 2 SH.

This course examines the essentials of management: planning, organizing, leading and controlling. Within this structure, students will explore how managers deal with the turbulent environment of business and the increasing complexity brought on by globalization and technological innovation. 4 SH.

Continuation of ACCT-301, emphasizing accounting and reporting issues for investing and financing activities of a business enterprise. Additional coverage of the latest developments in financial accounting. Prerequisite: ACCT-301. 4 SH.

This course deals primarily with projects that collect and structure data as part of the preparation for data analysis and visualization. Major emphasis is placed on managing a data collection project and data structuring to provide the basis for algorithmic analysis. Students will study project management, data manipulation, data modeling and Structured Query Language. 4 SH.

The study of business activities planned and implemented to facilitate the exchange or transfer of products and services so that both parties benefit. Examines markets and segments, as well as product, price, promotion and channel variable decisions. Considers marketing in profit and nonprofit sectors and in the international setting. 4 SH.

This course increases students’ understanding of the documentation, flow, and control of financial information from its initiation at the business document and transaction level to its summarization in the financial statements. Students also improve their understanding of the basic internal control concepts and their reading and interpretation of accounting system flowcharts. This course also covers small business accounting using QuickBooks software. Topics include: creating a chart of accounts, recording customer and vendor transactions, printing reports and preparing bank reconciliations.

Prerequisite: ACCT-200. 4 SH.

Examines the theory and practice of corporate financial management. Topics include the financial environment, time value of money, bond and stock valuation, and the capital asset pricing model. Also covers analysis of financial statements, financial forecasting, capital budgeting, long-term financing decisions, the cost of capital, capital structure, dividend policy and working capital management. Prerequisites: an introductory statistics course (MATH-108, MATH-180, MGMT-202 or PSYC-123), ACCT-200, and either ECON-105 or both ECON-201 and ECON-202. 4 SH.

Accounting

Choose from a variety of elective courses within this program to customize your goals.

This course provides accounting students with the theoretical, conceptual and technical foundation necessary to prepare and analyze consolidated financial statements and state and local governmental financial statements. Other topics will include foreign currency transactions and translation, derivatives and hedge accounting, and interim and segment reporting. This is an applied course focusing on the development of knowledge and skills through extensive practice. Prerequisite: ACCT-302. 4 SH.

Extended study of traditional managerial accounting concepts involving cost systems, budgeting, performance and variance analysis, behavior accounting, break-even and capital budgeting models, and direct cash flow statements. Introduction to more recently developed cost management topics, including the theory of constraints, activity-based costing/management, target costing, backflushing, learning curves, stochastic models and extension of capitalbudgeting models. Prerequisites: ACCT-330 and junior standing. 4 SH.

Accounting

Choose from a variety of elective courses within this program to customize your goals.

This course covers fundamental knowledge of basic federal income tax principles and concepts. Topics include gross income inclusions and exclusions, adjusted gross income, deductions, filing status, sales and exchanges of property, tax credits, and capital gains and losses. Basic Pennsylvania tax principles and concepts are also addressed. Students learn strategies for basic tax planning and tax research, and the course is designed to qualify students as VITA (Voluntary Income Tax Assistance) volunteers. Prerequisite: ACCT-200. 2 SH

This course is a continuation of ACCT-220. Technical tax topics are covered in greater detail, and students learn how to prepare tax returns using a computerized tax return preparation program. Students complete case studies that enable them to recognize and research tax issues, and they develop an ability to recognize, interpret and weigh the various and often conflicting sources of the tax law. Pre- or co-requisite: ACCT-220. 2 SH.

Provides an introduction to the theoretical and conceptual foundations of financial statement auditing. Topics include risk assessments, evidence collection and evaluation, sampling techniques, and reporting. Covers professional standards, the regulatory environment as well as the duties and responsibilities of certified public accountants. Emphasizes the application and emerging technologies that increase the effectiveness and efficiency of assurance services. Prerequisites: ACCT-309 and ACCT-302. 4 SH.

The capstone course for business seniors integrates much of the knowledge they gain from earlier courses. Uses a case method approach to solve problems facing top management. Emphasizes the global environment and strategic management decisions. Covers finance, management, marketing, technology, geography, leadership and other factors in both domestic and international cases. Heavy emphasis on the development of analytical skills and both written and oral communications skills. Prerequisites: senior standing and FINC-340, ACCT-330 and either MGMT-240 or MGMT-360. 4 SH. Capstone. CC: Writing Intensive.

This course provides accounting students with the theoretical, conceptual and technical foundation necessary to prepare and analyze consolidated financial statements and state and local governmental financial statements. Other topics will include foreign currency transactions and translation, derivatives and hedge accounting, and interim and segment reporting. This is an applied course focusing on the development of knowledge and skills through extensive practice. Prerequisite: ACCT-302. 4 SH.

This course provides a framework for understanding the technologies associated with algorithmic analysis and data presentation for business decision-making. Students will study analysis techniques that enable insights and patterns to be drawn from descriptive, predictive and prescriptive analytics. Student teams research and present tools that support these techniques, which are also investigated through individual research projects. Prerequisites: INFS-174. 4 SH. CC: Writing Intensive.

Accounting

Choose from a variety of elective courses within this program to customize your goals.

Accounting

Choose from a variety of elective courses within this program to customize your goals.

Provides an introduction to the basic concepts and standards underlying financial accounting systems. Focuses on recording and communicating financial information for use by investors, creditors, regulators and other external uses. Covers theoretical and practical issues related to the accounting and reporting of assets, liabilities, owners’ equity, revenues, expenses, gains and losses. Basic financial ratios are introduced and interpreted. Prerequisites: School of Business major or sophomore standing. 4 SH.

The legal environment as it relates to business. Considers essential elements of consumer protection law, employment law, environmental regulation, court procedures, torts, introduction to contracts, agency law and selected laws regarding corporations. Prerequisite: sophomore standing. 4 SH. CC: Ethics Intensive, Interdisciplinary.

This course covers fundamental knowledge of basic federal income tax principles and concepts. Topics include gross income inclusions and exclusions, adjusted gross income, deductions, filing status, sales and exchanges of property, tax credits, and capital gains and losses. Basic Pennsylvania tax principles and concepts are also addressed. Students learn strategies for basic tax planning and tax research, and the course is designed to qualify students as VITA (Voluntary Income Tax Assistance) volunteers. Prerequisite: ACCT-200. 2 SH

Provides an introduction to the fundamental concepts and commonly used tools in managerial accounting. Focuses on how to identify, measure, analyze and interpret accounting information from the manager’s perspective. Topics include traditional and emerging costing systems, cost behaviors, cost-volume-profit analysis, variance analysis, performance evaluation and management decision making. Prerequisites: ACCT-200. 4 SH.

Provides an introduction to the conceptual framework of financial accounting and in-depth coverage of reporting issues related to operating activities of business enterprises. Covers the preparation, presentation, and interpretation of the financial statements, with emphasis on revenue recognition, cash, receivables, inventory, and long-term assets. Students also gain an understanding of the standard setting process and the codification system of the Financial Accounting Standard Board (FASB). Prerequisite: ACCT-200. 4SH.

Continuation of ACCT-301, emphasizing accounting and reporting issues for investing and financing activities of a business enterprise. Additional coverage of the latest developments in financial accounting. Prerequisite: ACCT-301. 4 SH.

This course is a continuation of ACCT-220. Technical tax topics are covered in greater detail, and students learn how to prepare tax returns using a computerized tax return preparation program. Students complete case studies that enable them to recognize and research tax issues, and they develop an ability to recognize, interpret and weigh the various and often conflicting sources of the tax law. Pre- or co-requisite: ACCT-220. 2 SH.

This course increases students’ understanding of the documentation, flow, and control of financial information from its initiation at the business document and transaction level to its summarization in the financial statements. Students also improve their understanding of the basic internal control concepts and their reading and interpretation of accounting system flowcharts. This course also covers small business accounting using QuickBooks software. Topics include: creating a chart of accounts, recording customer and vendor transactions, printing reports and preparing bank reconciliations.

Prerequisite: ACCT-200. 4 SH.

A study of contracts, employment law, anti-trust law and commercial transactions. Includes negotiable instruments, sales, creditors’ rights, personal property and bailments. Prerequisite: ACCT-210. 2 SH.

Introduction to the theory and practice of accounting for nonprofit organizations, such as government operations, hospitals, colleges and arts facilities. Includes budgeting as well as bookkeeping and reporting practices. (Offered in alternate years.) Prerequisite: ACCT-200. 2 SH.

This course introduces the student to entrepreneurial finance and accounting topics, which are essential for the financial management of early-stage companies. The course topics include preparing financial projections, analyzing financial performance, managing cash flow, accessing investment and cash for business growth and determining the potential financial feasibility of new and growing ventures. This course is designed for students interested in pursuing entrepreneurial activity or financing ventures. Prerequisites: ACCT-200. 4SH.

This course provides an in-depth examination of the legal principles that govern real estate transactions. The course will cover the legal framework for property ownership, land use, financing, and leasing. Students will learn about the different types of legal instruments used in real estate transactions, including contracts, deeds, and mortgages. The course will also cover the regulatory environment for real estate, including zoning, differences in laws across states environmental law, and fair housing regulations. Pre-requisites: ACCT-210. 4 SH.

This course is a continuation of ACCT-305. Topics include the taxation of corporations and partnerships, estate and gift taxation, tax practice and procedure, and other topics likely to appear on the CPA exam. Students also complete a tax research project. Prerequisite: ACCT-305. 2 SH.

This course provides accounting students with the theoretical, conceptual and technical foundation necessary to prepare and analyze consolidated financial statements and state and local governmental financial statements. Other topics will include foreign currency transactions and translation, derivatives and hedge accounting, and interim and segment reporting. This is an applied course focusing on the development of knowledge and skills through extensive practice. Prerequisite: ACCT-302. 4 SH.

Provides an introduction to the theoretical and conceptual foundations of financial statement auditing. Topics include risk assessments, evidence collection and evaluation, sampling techniques, and reporting. Covers professional standards, the regulatory environment as well as the duties and responsibilities of certified public accountants. Emphasizes the application and emerging technologies that increase the effectiveness and efficiency of assurance services. Prerequisites: ACCT-309 and ACCT-302. 4 SH.

Students build on the tax accounting principles learned in previous courses and prepare tax returns through the VITA (Voluntary Income Tax Assistance) Program. This course enables students to address community-identified needs while developing their academic skills and commitment to their community. Students will pass exams for the Volunteer Income Tax Assistance (VITA) program, research and analyze emerging tax issues, assist individuals with completing their federal, state, and local income tax returns, maintain the highest degree of professional ethics and confidentiality, and engage in critical reflection of their service learning experiences. Prerequisite: ACCT-220. 4 SH.

Extended study of traditional managerial accounting concepts involving cost systems, budgeting, performance and variance analysis, behavior accounting, break-even and capital budgeting models, and direct cash flow statements. Introduction to more recently developed cost management topics, including the theory of constraints, activity-based costing/management, target costing, backflushing, learning curves, stochastic models and extension of capitalbudgeting models. Prerequisites: ACCT-330 and junior standing. 4 SH.

Topics of current importance and interest in accounting. Emphasizes readings from the current literature. Prerequisites: ACCT-200. 2 SH.

Individualized academic work for qualified students under faculty direction. Usually studies special topics not covered in regularly offered courses. Prerequisites: Junior or senior standing and approval of instructor and department. 2-4 SH.

An extensive accounting-related research project under faculty supervision. Prerequisites: Senior standing, formal proposal statement before registration, acceptance by faculty supervisor and department head’s permission. 2-4 SH.

A learning experience that cultivates a student’s academic and professional development through valuable work experience and the integration of classroom-acquired knowledge by working at a public accounting firm, corporation, governmental agency, or nonprofit organization. Prerequisites: Approval by the SWSB Internship Coordinator and acceptance by the organization. Graded on an S/U basis. 2 or 4 SH.

Sigmund Weis School of Business London Program Courses

Offered to students participating in the London Program of the Sigmund Weis School of Business, this course provides knowledge and exposure to the art of theatre performance by utilizing the rich offerings of the theatre and other fine arts resources in London and England. 4 SH. CC: Artistic Expression.

Offered to students participating in the London Program of the Sigmund Weis School of Business, this course introduces students to the theories and principles of diversity by examining Great Britain as a case study in diversity. The course explores key aspects diversity in relation to, but not limited to, class, race, gender and sexuality. A key focus will be location-specific study of social and cultural diversity through student exploration of the role played by culture, ethnicity, class, race and gender in Britain’s past and in its contemporary life. This will involve exploring the opportunities and challenges faced by individuals, businesses and non-profit organizations in their engagement with issues of equality and social justice. Students will learn about contemporary British culture and they will be able to compare that culture with that of the United States. 4 SH. CC: Diversity.

OFFP-SWSB SWSB London Program Planning The goal of this course is to prepare study abroad students for a semester’s study in the Sigmund Weis School of Business London Program. Students begin work toward achieving the cross-cultural learning goals; examples include examining definitions and aspects of culture and learning to recognize ethnocentrism. They will be introduced to observational and reflective techniques to be used on site and will begin an investigation of the history and culture of their destination. Many differences come into play: finances, physical health and safety, cultural expectations, and world affairs differ in relevance to the SU student studying on campus versus studying in London. This course will respond to the question of how to research, plan and prepare for a study abroad experience, as well as how to prepare to return home. This course also includes some mandatory workshops provided by the GO Program office. Prerequisite: Approval by the GO Program office 1 SH

The Sigmund Weis School of Business offers a London program for junior Weis School majors. Courses are taught by Sigmund Weis School faculty and by adjunct faculty from the London academic community. Fall or Spring semester students earn a full semester of Susquehanna University credit designed for the normal junior-level schedule including a four-credit internship. A shorter version of the program, including internship experiences may be offered during summer and/or winter break. Pre-requisite: OFFP-SWSB. London Program Planning. 0 SH. CC: Cross-Cultural Experience.

This course completes the cross-cultural requirement for students in the Sigmund Weis School of Business London Program. This course is designed to allow students to reflect on a cross-cultural experience and to integrate that experience into their social, intellectual, and academic life. They will explore the complexities of culture-both their own and that in which they have been immersed-in order to understand the possibilities and responsibilities of being a global citizen. Through short assignments, student presentations, a final paper and an opinion survey, students reflect on their learning in London coursework, company visits, consulting projects and more. Prerequisites: Completion of the SWSB London semester. 1 SH CC: Cross-Cultural Reflection.

When you enroll at Susquehanna, you’ll be paired with an advisor and application tool to guide you in your course planning and scheduling. The following is an excerpt from the complete course catalog. Enrolled students follow the requirements of the course catalog for the academic year in which they declare each major and/or minor, consult with their advisor(s).

Learning Goals

- Analyze risks using appropriate frameworks and professional judgment related to the use of accounting information.

- Identify and apply appropriate professional frameworks to record transactions and communicate accounting information.

- Identify and utilize relevant technology and tools to efficiently and effectively perform data analysis.

- Apply standards of professional conduct.

Honors in Accounting

The departmental honors program encourages and recognizes superior academic performance in accounting. To graduate with departmental honors, candidates must complete the following:

- Apply for and be accepted into the program during their junior year.

- Maintain a GPA of 3.50 in the department and 3.50 overall.

- Submit a satisfactory research paper based on the completion of 4 semester hours of ACCT-502 during their senior year.

- Present their research to the faculty and at Senior Scholars Day.

Departmental honors may be taken separately from or in conjunction with the University’s Honors Program.

150 Semester Hour Option

Accounting majors who intend to become licensed CPAs need to complete at least 150 semester hours of college-level education. This is a requirement for membership in the American Institute of Certified Public Accountants (AICPA), and it is a requirement of the licensure processes enacted by individual state boards of accountancy.

Susquehanna University accounting majors work with their academic advisors to earn 150 semester hours over their four years. Students usually earn an average of 18 hours per semester and complete a for-credit summer internship.

Students apply for CPA candidacy in the state where they intend to practice, and they should be knowledgeable about the applicable requirements for their expected licensing jurisdiction.

The Major in Accounting

A major in accounting requires the successful completion of the Business Foundation and the accounting courses listed below. No grade below a C- will be accepted toward graduation for foundation courses. Students who earn a grade below C- in a foundation course must retake the course during the next semester that it is offered.

The accounting course descriptions (provided below) identify course prerequisites. The catalog also suggests an order for completing courses within the Business Foundation and the accounting major.

First-semester students in the Sigmund Weis School of Business also enroll in MGMT-196 Global Business Perspectives (four semester hours). This course provides an introduction to liberal studies and college life, an overview of business functional areas, career opportunities and the Sigmund Weis School curriculum. This course satisfies the First-year Seminar requirement of the University’s Central Curriculum.

Double-counting restriction

A student can declare two majors within the Sigmund Weis School of Business, but they may not declare a double major in both 1) Marketing, and 2) Luxury Brand Marketing & Management. Students must complete all the requirements for both declared majors. Students may only double-count the courses included in the Business Foundation requirements. Therefore, if a course is used to satisfy a requirement of one major, that same course may not be used to fulfill a requirement of the second major within the School of Business.

Business Foundation Courses

Complete one of the following Introduction to Business classes:

- 4 MGMT-196 Global Business Perspectives

- 2 MGMT-138 Fundamentals of Business

Complete one of the following statistics classes :

- 4 MATH-108 Introduction to Statistics

- 4 MATH-180 Statistical Methods

- 4 MGMT-202 Business Statistics

- 4 PSYC-123 Statistics for the Behavioral Sciences

Required courses:

- 4 ACCT-200 Financial Accounting

- 4 ACCT-210 Legal Environment

- 4 ACCT-230 Managerial Accounting

- 4 ECON-201 Principles of Macroeconomics

- 4 ECON-202 Principles of Microeconomics

- 4 FINC-340 Corporate Financial Management

- 4 INFS-174 Data Collection and Modeling

- 4 INFS-472 Data Insight and Visualization

- 2 MGMT-105 Introduction to Professional Development

- 4 MGMT-240 Principles of Management

- 4 MGMT-400 Business Policy and Strategy

- 4 MKTG-280 Marketing

Requirements for the Major in Accounting

- 2 ACCT-220 Introduction to Taxation

- 4 ACCT-301 Intermediate Accounting I

- 4 ACCT-302 Intermediate Accounting II

- 2 ACCT-305 Federal Taxation

- 4 ACCT-309 Accounting Information Systems

- 4 ACCT-415 Advanced Accounting

- 4 ACCT-420 Auditing

- 4 ACCT-430 Advanced Managerial and Cost Accounting

To satisfy the major course requirements, courses must be completed with a grade of C- or better.

For the purposes of calculating the required 2.00 minimum GPA in the accounting major, the Accounting Department uses the following courses: ACCT-220 Introduction to Taxation, ACCT-301 Intermediate Accounting I, ACCT-302 Intermediate Accounting II, ACCT-305 Federal Taxation, ACCT-309 Accounting Information Systems, ACCT-415 Advanced Accounting, ACCT-420 Auditing and ACCT-430 Advanced Managerial and Cost Accounting. An accounting student must take at least 50 percent of these courses at Susquehanna.

When you enroll at Susquehanna, you’ll be paired with an advisor and application tool to guide you in your course planning and scheduling. The following is an excerpt from the complete course catalog. Enrolled students follow the requirements of the course catalog for the academic year in which they declare each major and/or minor and consult with their advisor(s).

The minor in accounting enables students to enhance their career path through advanced studies in the accounting discipline. To complete the minor, students must have a GPA of at least 2.00 in the minor coursework and no grade below a C-.

The following courses are required:

- 4 ACCT-200 Financial Accounting

- 4 ACCT-301 Intermediate Accounting I

Students then select 12 semester hours from the following:

- 4 ACCT-210 Legal Environment

- 2 ACCT-220 Introduction to Taxation

- 4 ACCT-230 Managerial Accounting

- 4 ACCT-302 Intermediate Accounting II

- 2 ACCT-305 Federal Taxation

- 4 ACCT-309 Accounting Information Systems

- 4 ACCT-415 Advanced Accounting

- 4 ACCT-420 Auditing

- 4 ACCT-430 Advanced Managerial and Cost Accounting

- 2-4 ACCT 496 Topics in Accounting

Double-counting restriction

Only 4 semester hours of this minor may be double-counted toward the student’s major.

- Audit and assurance services

- Tax compliance and planning

- Forensic accounting

- Consulting and advisory services

- Financial/budgetary analyst

Recent Employers

Beyond Susquehanna

Where Passion Meets Purpose

Straight from the Nest

“I have been able to take on every opportunity I strived for while completing 150 credits in four years. Attending a small university that cares about its students and their success, while participating in a semester-long study abroad trip with an accounting internship, is a dream come true. As an incoming Deloitte Tax employee, I was able to earn certifications that will only advance my knowledge of different systems within my future career.”

— Megan Sypniewski ’23

“The community at Susquehanna feels like a family. Students, faculty and staff share a tight-knit bond — everyone knows each other and always takes the time to say ‘hi,’ whether in class, on campus pathways or in the cafeteria.”

— Connor Aitken ’25

“All the professors, faculty and staff really want you to succeed. You’re able to express your concerns, your ideas and your potential career paths without fear of judgment. And you’re able to garner a lot advice from different people who may have had varied experiences and help mold your time here.”

— Bianca Lezcano ’25

“A small school is a great option and something that makes Susquehanna unique. I think the community atmosphere we build makes us stand out. We form long-lasting personal connections with our peers and professors because of our smaller class sizes. Being a small school also means we have a dedicated alumni network. And, I absolutely love our alumni.”

— Katie Yoder ’27

Meet the Faculty

TAKE A VIRTUAL TOUR

Launch Apfelbaum Hall – Business & CommunicationsYOU MAY ALSO BE INTERESTED IN

See the full list of related programs on the Sigmund Weis School of Business page.

Have Questions?

Contact Us

Start your journey.